| Filed by the Registrant | ||

| Filed by a Party other than the Registrant | o | |

| o | Preliminary Proxy Statement | |

| o | Confidential, For Use of the Commission Only | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | |

| ý | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials: | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(c) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-13-015510/logo_camdennational-blk.jpg)

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-13-015510/logo_camdennational-blk.jpg)

| (1) | Election of Directors. To elect four persons to the Company’s Board of Directors, each to serve for a term of three years and |

| (2) | Shareholder “Say-on-Pay.” To approve, by a non-binding advisory vote, the compensation of the Company’s named executive officers. |

| (3) | Ratification of Appointment of Independent Registered Public Accounting Firm. To ratify the appointment of Berry Dunn McNeil & Parker, LLC as the Company’s independent registered public accounting firm for the year ending December 31, |

| (4) | Other Business. To consider and act upon such other business, matters or proposals as may properly come before the Annual Meeting. |

| By Order of the Board of Directors, | ||||

| ||||

John W. Holmes, Secretary | ||||

| March | ||||

PROXY STATEMENT TABLE OF CONTENTS | |

| Page | |

| THE ANNUAL MEETING AND VOTING PROCEDURES | |

| General Information | 1 |

| Quorum and Vote Required | 1 |

| Voting | 1 |

| Revocability of Proxies | 2 |

| Importation Notice Regarding the Availability of Proxy Materials | 2 |

| PROPOSALS TO BE VOTED UPON AT ANNUAL MEETING | |

| Election of Directors (Proposal 1) | 3 |

| Non-binding Advisory Vote on Compensation of the Company's Named Executive Officers (Proposal 2) | 4 |

| Ratification of Appointment of Independent Registered Public Accounting Firm (Proposal 3) | 5 |

| Other Matters | 5 |

| BOARD OF DIRECTOR AND CORPORATE GOVERNANCE INFORMATION | |

| Current Board Members | 6 |

| Corporate Governance Information | 8 |

| Leadership Structure | 8 |

| Shareholder Communication with the Board | 8 |

| Shareholder Director Nominations | 8 |

| Shareholder Proposals for Next Annual Meeting | 8 |

| Director Attendance at Meetings of the Board and its Committees and Annual Shareholder Meeting | 9 |

| Corporate Governance and Risk Committee | 9 |

| Audit Committee | 10 |

| Report of the Audit Committee | 11 |

| Compensation Committee | 11 |

| Compensation Committee Interlocks and Insider Participation | 11 |

| Capital Planning Committee | 12 |

| Technology Committee | 12 |

| Director Qualifications and Experience | 12 |

| Board Evaluations | 13 |

| Mandatory Director Retirement | 13 |

| Director Stock Ownership Guidelines | 13 |

| Director Independence | 13 |

| Director Compensation | 13 |

| Director Retainer and Meeting Fees | 14 |

| Director Deferred Compensation Plan | 14 |

| Related Party Transactions | 14 |

| EXECUTIVE OFFICER INFORMATION | |

| Current Executive Officers | 15 |

| Compensation Committee Report | 16 |

| Compensation Discussion and Analysis | 16 |

| Overview | 16 |

PROXY STATEMENT TABLE OF CONTENTS (continued) | |

EXECUTIVE OFFICER INFORMATION (continued) | |

| Financial Highlights | 16 |

| Executive Summary | 17 |

| Compensation Committee Activity and Key Initiatives During 2013 | 17 |

| Compensation Philosophy and Objectives | 18 |

| Role of the Compensation Committee | 18 |

| Role of Executives in Compensation Committee Deliberations | 19 |

| Interaction with Consultants | 19 |

| Compensation Committee’s Relationship with its Independent Compensation Consultant | 19 |

| Risk Review | 20 |

| Benchmarking Compensation | 20 |

| Elements of Compensation | 21 |

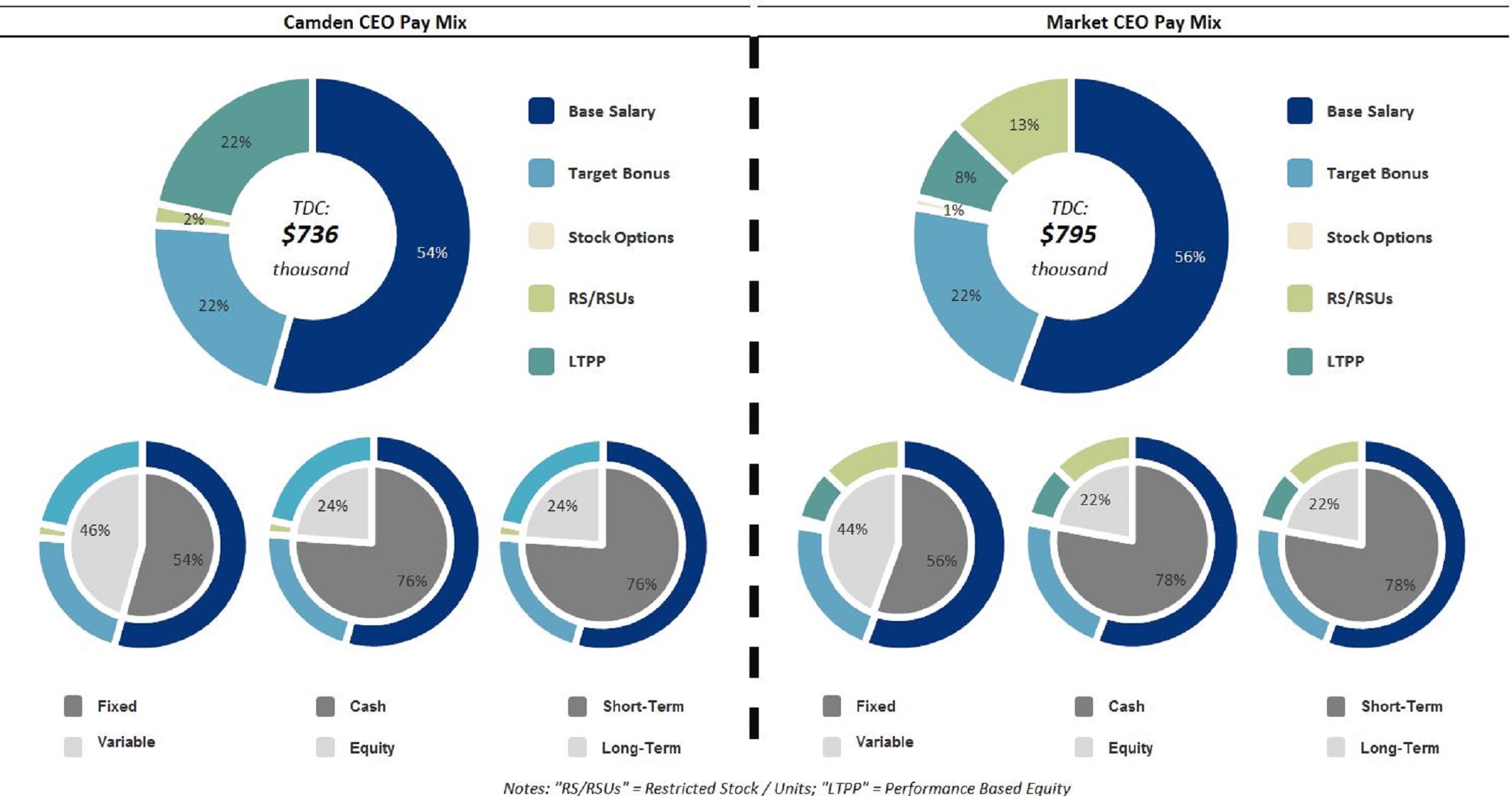

| Pay Mix | 21 |

| Base Salaries | 22 |

| Annual Cash Incentive Compensation | 23 |

| Long-Term Equity Compensation | 24 |

| Retirement and Other Benefits | 26 |

| Other Compensation and Benefits | 27 |

| Employment and Change in Control Agreements | 27 |

| Stock Practice and Policy | 27 |

| Tax and Accounting Consideration | 28 |

| Tabular Disclosures Regarding Named Executive Officers | 29 |

| Summary Compensation Table | 29 |

| Grants of Plan-Based Awards Table | 30 |

| Outstanding Equity Awards at Fiscal Year-End (Option Awards) | 31 |

| Outstanding Equity Awards at Fiscal Year-End (Stock Awards) | 32 |

| Option Exercises and Stock Vested Table | 33 |

| Pension Benefits Table | 33 |

| Change in Control Agreements | 34 |

| Potential Payments Upon Termination or Change in Control | 35 |

| STOCK OWNERSHIP AND OTHER MATTERS | |

| Common Stock Beneficially Owned by any Entity with 5% or More of Common Stock and Owned by Directors and Executive Officers | 36 |

| Section 16(a) Beneficial Ownership Reporting Compliance | 37 |

| Solicitation of Proxies | 37 |

2014.

Meeting for which you do not make a selection.

The Company will bear the cost of soliciting proxies. In addition to use of the mail, proxies may be solicited personally or by telephone by the Company’s directors and officers, who will not be specially compensated for such solicitation. The Company has engaged American Stock Transfer and Trust Company, its transfer agent, to solicit proxies held by brokers and nominees, and will reimburse it for reasonable out-of-pocket expenses incurred in the solicitation of proxies. Brokerage firms and other custodians, nominees and fiduciaries will be requested to forward these soliciting materials to their principals and the Company will, upon request, reimburse them for their reasonable expenses of doing so. The stock transfer books will remain open between the Record Date and the date of the Annual Meeting.

29, 2014:

9.

2012.

As of the Record Date, there were 7,654,809 shares of Common Stock outstanding, held of record by approximately 1,300 shareholders.

| First Year Elected or Appointed as Director of the: | ||||||||||

| Name | Age | Company | Bank | Acadia Trust | Term Expires | |||||

| Robert J. Campbell | 65 | 1999 | n/a | 2001 | 2017 | |||||

| Craig S. Gunderson | 50 | 2011 | n/a | n/a | 2017 | |||||

| John W. Holmes | 68 | 1988 | 1988 | n/a | 2017 | |||||

| John M. Rohman | 68 | 2010 | 2007 | n/a | 2017 | |||||

| Ann W. Bresnahan | 62 | 1990 | 1990 | 2009 | 2015 | |||||

| Gregory A. Dufour | 53 | 2009 | 2004 | 2006 | 2015 | |||||

S. Catherine Longley(1) | 60 | 2014 | n/a | n/a | 2015 | |||||

| David C. Flanagan | 60 | 2005 | 1998 | n/a | 2016 | |||||

| James H. Page, Ph.D. | 61 | 2008 | n/a | n/a | 2016 | |||||

| Robin A. Sawyer, CPA | 46 | 2004 | n/a | n/a | 2016 | |||||

| Karen W. Stanley | 68 | 2008 | 2010 | 2013 | 2016 | |||||

| (1) | Ms. Longley was appointed as a director of the Company by the Board in February 2014 to be effective April 1, 2014. Ms. Longley will serve until the 2015 Annual Meeting of Shareholders. |

| Common Stock | Options Exercisable Within 60 days | Total Beneficial Ownership | Percentage of Common Shares Outstanding | |||||||||||||

| 5% or Greater Shareholders: | ||||||||||||||||

| BlackRock, Inc. | ||||||||||||||||

| 40 East 52nd Street, New York, NY 10022 | 491,934 | 491,934 | 6.43 | % | ||||||||||||

| The Vanguard Group | ||||||||||||||||

| 100 Vanguard Blvd., Malvern, PA 19355 | 412,417 | 412,417 | 5.39 | % | ||||||||||||

| Directors, Nominees and Executive Officers: | ||||||||||||||||

| Ann W. Bresnahan | 23,940 | 23,940 | * | |||||||||||||

| Joanne T. Campbell | 6,044 | 5,500 | 11,544 | * | ||||||||||||

| Robert J. Campbell | 1,500 | 1,500 | * | |||||||||||||

| Gregory A. Dufour | 28,991 | 2,000 | 30,991 | * | ||||||||||||

| David C. Flanagan | 4,019 | 4,019 | * | |||||||||||||

| Peter F. Greene | 6,829 | (1) | 1,500 | 8,329 | * | |||||||||||

| Craig S. Gunderson | 1,585 | 1,585 | * | |||||||||||||

| Deborah A. Jordan, CPA | 9,332 | 5,000 | 14,332 | * | ||||||||||||

| John W. Holmes | 11,000 | 11,000 | * | |||||||||||||

| Timothy P. Nightingale | 8,404 | 8,000 | 16,404 | * | ||||||||||||

| James H. Page, Ph.D. | 1,500 | 1,500 | * | |||||||||||||

| June B. Parent | 6,559 | (2) | 7,000 | 13,559 | * | |||||||||||

| John M. Rohman | 1,450 | (3) | 1,450 | * | ||||||||||||

| Robin A. Sawyer, CPA | 1,592 | (3) | 1,592 | * | ||||||||||||

| Karen W. Stanley | 2,408 | 2,408 | * | |||||||||||||

| All directors, nominees, and executive officers as a group (15 persons): | 115,153 | 29,000 | 144,153 | 1.88 | % | |||||||||||

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, executive officers and persons who own more than 10% of the Company’s common stock (collectively, “Section 16 Persons”), to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Section 16 Persons are required by regulation to furnish the Company with copies of all Section 16(a) reports they file. Based solelyChief Executive Officer for Camden National Bank. He also serves on our review of the copies of such reports and written representations received by the Company, we believe that each of the Company’s Section 16 Persons has complied with all applicable Section 16(a) filing requirements during the fiscal year ended December 31, 2012, except that Ms. Campbell, Mr. Greene, Ms. Jordan, Mr. Nightingale and Ms. Parent each filed one late Form 4 in connection with the purchase of Management Stock Purchase Plan shares due to Company error.

The following table sets forth certain information with respect to each of the nominees, continuing directors and executive officers:

| Name | Principal Occupation for the Past Five Years | Age | First Year Elected or Appointed as Officer or Director of the: | |||||||||

| Company | Bank | Acadia Trust | Term Expires | |||||||||

| Nominees (4) | ||||||||||||

| David C. Flanagan | Mr. Flanagan is President of Viking Lumber, Inc. a family-owned lumber and building supply business with ten locations in mid-coast Maine, a position he has held since 1978. Mr. Flanagan also serves as President of Pine Tree Products. | 59 | 2005 | 1998 | n/a | 2016 | ||||||

| James H. Page, Ph.D. | Dr. Page is the Chancellor of the University of Maine System, with responsibilities for its seven campuses, law school, and associated programs and facilities. Previously, Dr. Page was Chief Executive Officer of the James W. Sewall Company in Old Town, Maine, which provides comprehensive consulting services in forestry, engineering, and geographic information management for municipal government, utilities, and the natural resource industry prior to taking the chancellor’s position. Dr. Page joined the James W. Sewall Company in 1997 following a career in academia. Dr. Page has also been an Adjunct Professor as well as a member of the Board of Visitors at the University of Maine at Orono. He is the founding director of the Gulf of Maine Oceanographic Observing System. He is also an ex officio Board member of Maine Public Broadcasting Network and the Alfond Scholarship Program. | 60 | 2008 | n/a | n/a | 2016 | ||||||

| Name | Principal Occupation for the Past Five Years | Age | First Year Elected or Appointed as Officer or Director of the: | |||||||||

| Company | Bank | Acadia Trust | Term Expires | |||||||||

| Robin A. Sawyer, CPA | Ms. Sawyer is Vice President, Corporate Controller at Fairchild Semiconductor (NYSE: FCS), a position she has held since November 2002. In addition, from October 2005 to March 2006, she served as interim Co-Chief Financial Officer and as the Principal Financial Officer at Fairchild Semiconductor. Ms. Sawyer joined Fairchild Semiconductor in 2000 as Manager of Financial Planning and Analysis. From 1998 to 2000, Ms. Sawyer was employed by Cornerstone Brands, Inc. as Director of Financial Planning and Reporting. Prior to 1998, Ms. Sawyer worked at Baker, Newman & Noyes, LLC and its predecessor firm, Ernst & Young. | 45 | 2004 | n/a | n/a | 2016 | ||||||

| Karen W. Stanley | Ms. Stanley was named Chairman of the Company and Chairman of Camden National Bank in May 2010. Ms. Stanley joined the Company’s Board of Directors in January 2008 following the acquisition of Union Bankshares Company, where she had been a Director since 2004. Previously, Ms. Stanley was co-owner of Stanley Subaru in Ellsworth, Maine from 1999 until February 2005. Ms. Stanley also served with Priority Management, an international training and development firm, as a member of the senior management team with their international headquarters. Prior to that, she served as Vice President, Personal Banking for Overseas Executives with Citibank N.A. Ms. Stanley began her career in sales with the Xerox Corporation. Ms. Stanley has served as the past Chair and currently serving as trustee of Maine Coast Memorial Hospital and Chair of Hancock County Committee of the Maine Community Foundation. | 67 | 2008 | 2010 | n/a | 2016 | ||||||

| Name | Principal Occupation for the Past Five Years | Age | First Year Elected or Appointed as Officer or Director of the: | |||||||||

| Company | Bank | Acadia Trust | Term Expires | |||||||||

| Continuing Directors (6) | ||||||||||||

| Ann W. Bresnahan | Ms. Bresnahan has been a full time volunteer and civic leader since 1970. Ms. Bresnahan has served as trustee of Pen Bay Healthcare since 2005 and currently serves on the investment and governance committees. Ms. Bresnahan serves as chair of Pen Bay Healthcare Foundation and as an advisory committee member with the Mitchell Institute. Her past community involvement includes Camden Outing Club, Owls Head Transportation Museum, The Hurricane Island Outward Bound School, The Ethel Walker School, and the First Congregational Church. She is currently treasurer and board member of Partners for Enrichment. | 61 | 1990 | 1990 | 2009 | 2015 | ||||||

| Robert J. Campbell | Mr. Campbell has been Partner in the investment management firm of Beck, Mack & Oliver in New York, New York, since 1991. Mr. Campbell has served as board member of Enstar Group, Limited (NYSE: ESGR), since 2007 and as Chairman of the Board since November 2011, and he is chair of the audit and investment committee. As a Rockport resident, Mr. Campbell serves on the investment committee for the Center for Furniture Craftsmanship and the Town of Rockport. | 64 | 1999 | n/a | 2001 | 2014 | ||||||

| Gregory A. Dufour | Mr. Dufour has been President and Chief Executive Officer of Camden National Corporation since January 2009. Mr. Dufour joined the Company in April 2001 as Senior Vice President of Finance. In August of 2002, he assumed additional responsibility for Operations and Technology until December 2003. In January 2004, Mr. Dufour was named Chief Banking Officer for the Company and President and Chief Operating Officer for Camden National Bank, and then in January 2006, he became President and Chief Executive Officer for Camden National Bank. He also serves on the Board of Directors of Camden National Bank and as Chairman of the Board of Directors of Acadia Trust. Prior to joining the Company, Mr. Dufour was Managing Director of Finance and a member of the Executive Operating Group for IBEX Capital Markets in Boston, Massachusetts. In addition to his experience at IBEX, Mr. Dufour held various financial management positions with FleetBoston Corporation and its affiliates, including Vice President and Controller of Debt Capital Markets, Controller of Investment Banking and Banking Group Controller. Mr. Dufour serves as trustee and corporate secretary of PenBay Healthcare System in Rockport, Maine and as trustee of Saint Joseph’s College in Standish, Maine. | 53 | 2009 | 2004 | 2006 | 2015 | ||||||

| Name | Principal Occupation for the Past Five Years | Age | First Year Elected or Appointed as Officer or Director of the: | |||||||||

| Company | Bank | Acadia Trust | Term Expires | |||||||||

| Craig S. Gunderson | Mr. Gunderson is President and Chief Executive Officer of Oxford Networks, headquartered in Lewiston, Maine. Prior to joining Oxford Networks in 2003, Mr. Gunderson was employed as Minnesota State Vice President for Frontier/Citizens Communications, where he was responsible for all facets of providing telecommunications services to 280,000 access lines in Minnesota and North Dakota. Mr. Gunderson serves as Vice Chair of the board and Chair of the Planning Committee of St. Mary’s Hospital in Lewiston, and is also a member of the board of the Lewiston Auburn Economic Growth Council. He also serves as a board member of Maine & Company. | 49 | 2011 | n/a | n/a | 2014 | ||||||

| John W. Holmes | Mr. Holmes is President and majority owner of Consumers Fuel Company in Belfast, Maine, a position he has held since 1977. Mr. Holmes serves as Trustee of the Belfast Free Library. | 67 | 1988 | 1988 | n/a | 2014 | ||||||

| John M. Rohman | Mr. Rohman was employed by WBRC Architects•Engineers, headquartered in Bangor, Maine from 1973 until 2011, most recently as Chairman of the Board. A longtime Bangor resident, Mr. Rohman has won many awards for his extensive public service and numerous board activities that focus on education, the arts, economic development, and public policy. Mr. Rohman’s past community involvement includes serving as a president of the Bangor Region Chamber of Commerce, director for the National Folk Festival in Bangor, the Bangor Symphony Orchestra, and Maine Crafts Association. He was also a member of the Bangor City Council and served as the mayor of Bangor in 2001. He is currently a Husson University trustee. | 67 | 2010 | 2007 | n/a | 2014 | ||||||

| Executive Officers (6) | ||||||||||||

| Joanne T. Campbell EVP, Risk Management | Ms. Campbell joined the Company in 1996 as Vice President, Manager of Residential Real Estate. She was promoted to Senior Vice President, Compliance, Audit & CRA in 2002, and then to Senior Vice President, Risk Management in 2005 and more recently to Executive Vice President in January 2011. As of January 2008, Ms. Campbell’s responsibilities expanded to include all areas of Risk Management for the Company. Ms. Campbell currently serves as Chair of the board for Community Housing of Maine, President of Camden Affordable Housing Organization, Chair of Town of Camden Housing Committee, and a member of the ABA Regulatory Compliance Conference Planning Committee. | 50 | 2002 | 1996 | n/a | n/a | ||||||

| Name | Principal Occupation for the Past Five Years | Age | First Year Elected or Appointed as Officer or Director of the: | |||||||||

| Company | Bank | Acadia Trust | Term Expires | |||||||||

| Gregory A. Dufour President & CEO | See above information inContinuing Directors. | |||||||||||

| Peter F. Greene EVP, Operations and Technology | Mr. Greene joined the Company in January 2008 with the acquisition of Union Bankshares Company. Mr. Greene joined Union Trust Company in 1982 and was promoted to Senior Vice President, Senior Bank Services Officer in 1999 and to Senior Vice President, Chief Administrative Officer in 2003, a position he held until he joined the Company as Senior Vice President of Operations and Technology. In January 2011, he was promoted to Executive Vice President. Mr. Greene currently serves on the Grant Committee for the Washington County Fund of the Maine Community Foundation. | 53 | 2008 | n/a | n/a | n/a | ||||||

| Deborah A. Jordan, CPA EVP & CFO | Ms. Jordan joined the Company in September 2008 as Senior Vice President, Chief Financial Officer, and Principal Financial and Accounting Officer and promoted to Executive Vice President in January 2011. Ms. Jordan was previously Executive Vice President and Chief Financial Officer of Merrill Merchants Bancshares, Inc. in Bangor, Maine, from January 1993 to August 2008. Ms. Jordan worked at Arthur Andersen & Co. from 1987 to 1992. Ms. Jordan currently serves on the Board and is the Treasurer for the Camden Public Library. | 47 | 2008 | n/a | n/a | n/a | ||||||

| Timothy P. Nightingale EVP, Senior Loan Officer | Mr. Nightingale joined the Company in March 2000 as Regional Vice President of UnitedKingfield Bank. In 2001, Mr. Nightingale was named Senior Lending Officer at UnitedKingfield Bank and promoted to Senior Vice President in 2003. In September 2006, the Company merged UnitedKingfield Bank into Camden National Bank, at which time Mr. Nightingale was named Senior Vice President, Senior Lending Officer for Camden National Bank. In January 2011, he was promoted to Executive Vice President. Mr. Nightingale serves on the board of directors for Maine Technology Institute and is a member of the Bank Advisory Committee for the Finance Authority of Maine. | 55 | n/a | 2000 | n/a | n/a | ||||||

| Name | Principal Occupation for the Past Five Years | Age | First Year Elected or Appointed as Officer or Director of the: | |||||||||

| Company | Bank | Acadia Trust | Term Expires | |||||||||

| June B. Parent EVP, Retail Banking | Ms. Parent rejoined the Company in July 1995 and was promoted to Vice President of Human Resources in 1999. In December 2003, she made a career change to the retail banking division of the Bank and was promoted to Senior Vice President and Senior Retail Banking Officer. In January 2011, she was promoted to Executive Vice President. Ms. Parent currently serves as Board President for the Penobscot Bay Regional Chamber of Commerce and Chairman for the New England Insurance Trust. | 49 | n/a | 1995 | n/a | n/a | ||||||

All of the executive officers will hold office at the discretion of the Company’s Board of Directors. There are no arrangements or understandings between any of the directors, or officers or any other persons pursuant to which any of the above directors have been selected as directors, or any of the above officers have been selected as officers. There are no “family relationships” among the above directors and officers, as the Commission defines that term.

During 2012, the Board of Directors of the Company held eleven regular meetingsCamden National Bank and four special meetings. Each of the directors attended at least 75% of the total number of meetings of the Company’s Board and the committees of the Company Board on which he or she served during the year. Although we do not have a formal policy regarding attendance by membersas Chairman of the Board of Directors at annual meetings of shareholders, we expect that our directors will attendAcadia Trust. Prior to joining the meeting, even though we recognize that directors occasionally may be unable to attend for personal or professional reasons. In 2012, eightCompany, Mr. Dufour was Managing Director of Finance and a member of the Executive Operating Group for IBEX Capital Markets in Boston, Massachusetts. In addition to his experience at IBEX, Mr. Dufour held various financial management positions with FleetBoston Corporation and its affiliates, including Vice President and Controller of Debt Capital Markets, Controller of Investment Banking and Banking Group Controller. Mr. Dufour serves as trustee and corporate secretary of PenBay Healthcare System in Rockport, Maine and as trustee of Saint Joseph’s College in Standish, Maine.

The BoardMaine. Mr. Flanagan has five standing committees:also served as a member of the board of directors of the Waldo County YMCA for 18 years.

The following table sets forth the membersmember of the Board andof Visitors at the committeesUniversity of Maine at Orono. He is the founding director of the Gulf of Maine Oceanographic Observing System. He is also an ex officio Board on which theymember of the Alfond Scholarship Program.

Corporate Governance Information

Our Board has determined that the following directors, constituting nine of the Company’s ten directors, are each an “independent director” as such term is defined in NASDAQ’s listing standards: Messrs. Campbell, Flanagan, Gunderson, Holmes, Page and Rohman and Mses. Bresnahan, Sawyer, and Stanley. Our Board also has determined that each member of the Audit Committee, the Compensation Committee, and the Corporate Governance and Risk Committee meets the independence requirements applicable to those committees as prescribed by NASDAQ, the Securities and Exchange Commission, the Internal Revenue Service, and applicable committee charters.

The Audit Committee assists the Board of Directors in overseeing, among other things, the integrity of the Company’s financial reports, the Company’s compliance with legal and regulatory requirements, the qualifications and independence of the Company’s independent accountants, and the performance of the Company’s internal audit function and independent accountants. The Audit Committee meets each quarter with the Company’s independent accountants and management to review the Company’s interim financial results before the publication of quarterly earnings press releases. On a quarterly basis, the Audit Committee also reviews the adequacy of the Company’s internal controls and summaries of regulatory examinations to assess the Company’s program for complying with laws and regulations. The Audit Committee also meets separately each quarter in executive session with the independent accountants. The Audit Committee oversees and approves the selection and performance of the Internal Auditors and reviews and approves the Company’s internal audit plan. Annually the Audit Committee also reviews and updates the Committee charter, reviews and evaluates Committee performance, and participates in the preparation of the audit report contained in this Proxy Statement.

The Board of Directors has determinedadopted a Code of Business Conduct and Ethics that all four members of the Audit Committee satisfy the financial literacy requirements of the NASDAQ listing standards. Additionally, the Board of Directors has determined that Ms. Sawyer, CPA, qualifies as an “audit committee financial expert” as defined by the SEC rules. This Committee met eight times during 2012.applies to our employees and officers. The Audit Committee operates under a written charter, a copy of which is available on the Company’s website atwww.camdennational.com.

The Compensation Committee assists the Board of Directors in discharging the Board’s responsibilities relating to compensation of the Company’s directorsCode covers compliance with law; fair and executives, and oversees the Company’s overall compensation and benefit programs. The Compensation Committee also reviews the Company’s incentive compensation and other equity plans and recommends changes to the plans as needed. The Compensation Committee reviews all compensation components for the Company’s Chief Executive Officer and other executive officers, including base salary, annual incentive, long-term incentives, benefits and other elements of compensation. In addition to reviewing competitive market factors, the Compensation Committee also examines the total compensation mix, and how all elements, in the aggregate, comprise the executive’s total compensation package. Decisions by the Compensation Committee with respect to the compensation of executive officers are approved by the full Board of Directors.

The Compensation Committee met eleven times during 2012. The Compensation Committee operates under a written charter, a copy of which is available on the Company’s website atwww.camdennational.com.

Mr. Flanagan (Chair), Gunderson, and Holmes and Ms. Stanley served as members of the Compensation Committee. Mr. Rendle Jones also served on the Compensation Committee in 2012, until his retirement from the Board of Directors in December 2012. No member of the Compensation Committee was an officer, employee or former employee of the Company, or had any relationshiphonest dealings with the Company, requiringwith competitors and with others; fair and honest disclosure herein.

The current members of the Compensation Committee are Messrs. Flanagan, Gunderson, and Holmes and Ms. Stanley. None of these persons has served as an officer or employee of the Company. None of these persons had any relationships with the Company requiring disclosure under applicable rules and regulations of the SEC.

The Company believes that a key element of effective risk management is strong corporate governance, and accordingly has combined the oversight of these areas in a single committee, Corporate Governance and Risk Committee. This committee assists the Board of Directors by proposing director nominees to the Board; overseeing an annual evaluation of the Board, managementpublic; and Board committees; overseeing the Company’s risk management program; and reviewing the adequacy of the Company’s Articles of Incorporation and By-laws.

The Corporate Governance and Risk Committee assists the Board of Directors by identifying and recommending individuals qualified to serve as directors of the Company, and as chairs and members of committees of the Board of Directors. The Corporate Governance and Risk Committee is also responsibleprocedures for certain corporate governance practices, including the development of ethical conduct standards for our directors, officers and employees and an annual evaluation to determine whether the Board of Directors and its committees are functioning effectively.

The Corporate Governance and Risk Committee expects to identify nominees to serve as directors of the Company primarily by accepting and considering the suggestions and nominations made by directors, management and shareholders. To date, the Corporate Governance and Risk Committee has not engaged any third parties to assist in identifying candidates for the Board of Directors. In general, the Corporate Governance and Risk Committee would expect to re-nominate incumbent directors who express an interest in continuing to serve on the Board. The Corporate Governance and Risk Committee has established minimum qualifications for recommended nominees that include evaluating nominees for directors based on their integrity, judgment, independence, financial and business acumen, relevant experience and their ability to represent and act on behalf of all shareholders, as well as the needs of the Board of Directors. In addition to any other standards, the Corporate Governance and Risk Committee may deem appropriate from time to time for the overall structure and composition of the Board, the Corporate Governance and Risk Committee may consider the following factors when recommending that the Board select persons for nomination:

The Corporate Governance and Risk Committee also oversee the risk management practices and oversight for the Company. The Corporate Governance and Risk Committee annually reviews the Company’s Risk Management Policy, and semi-annually the Risk Assessment Process, and then recommend the policy to the Board for approval. It is the intent of the Company and its Board of Directors to ensure, through this Policy, which identifies our major areas of risk, and related policies, procedures and programs to manage those risks, that it has a sound enterprise risk management program that identifies, measures, monitors, eliminates, mitigates and controls risk in the Company’s systems, processes, and people. Direct oversight and responsibility for the Company’s Risk Management Program is delegated to the Executive Vice President of Risk Management, who is a member of executive management. This structure reflects the Company’s commitment to risk management. The Executive Vice President of Risk Management reports to the President and Chief Executive Officer of the Company and provides reports and serves as management’s liaison to both the Corporate Governance and Risk Committee and Audit Committee. The Company’s Risk Management

Program is designed to provide sufficient information to management and the Board of Directors to assist them in properly and adequately evaluating the Company’s compliance with the Risk Management Program.

ThereCode. You can be no assurance that the Board’s risk oversight structure has identifiedreview our Code of Conduct and addressed every potential material risk, and there may be additional risks that could arise in the Company’s business. Both known and unknown risks could result in potential material financial and/or business losses despite the Board’s efforts to oversee risk.

The Corporate Governance and Risk Committee held six meetings during 2012. The Corporate Governance and Risk Committee operate under a written charter, a copy of which is availableEthics on the Company’sour website located atwww.camdennational.com.

The Capital Planning Committee assists the Board of Directors in discharging the Board’s responsibilities relating to management of capital for the Company and its subsidiaries, and coordinates capital generation and deployment activities. The Committee is also responsible for ensuring compliance with regulations pertaining to capital structure and levels. This Committee met once during 2012.

The Technology Committee assists the Board of Directors in discharging the Board’s responsibilities relating to management of technology efforts to meet current strategic needs as well as position itself to anticipate future requirements that are a result of organizational growth and technology innovations. This Committee met three times during 2012.

Our shareholders may communicate directly with the members of the Board of Directors by writing directly to those individuals c/o Camden National Corporation at the following address: Two Elm Street, Camden, Maine 04843. Our policy is to forward, and not to intentionally screen, any mail received at our corporate office that is sent directly to an individual director.

| Name of Director | Corporate Governance and Risk | Audit | Compensation | Capital Planning | Technology | |||||

Non-Employee Directors(1): | ||||||||||

| Ann W. Bresnahan | Member | Member | ||||||||

| Robert J. Campbell | Member | Chair | ||||||||

| David C. Flanagan | Member | Chair | ||||||||

| Craig S. Gunderson | Member | Member | ||||||||

| John W. Holmes | Member | |||||||||

| James H. Page | Chair | |||||||||

| John M. Rohman | Member | Member | ||||||||

| Robin A. Sawyer | Chair | Member | ||||||||

| Karen W. Stanley | Chair | Member | Member | |||||||

| Employee Directors: | ||||||||||

| Gregory A. Dufour | Member | Member | ||||||||

| (1) | Excludes Ms. Longley as she became a director of the Company effective April 1, 2014. Ms. Longley will serve as a member on the Company's Capital Planning Committee |

| A. Bresnahan | R. Campbell | G. Dufour | D. Flanagan | C. Gunderson | J. Holmes | S.C. Longley | J. Page | J. Rohman | R. Sawyer | K. Stanley | ||||||||||||||||||||||||||||||||||

| Diversity | ||||||||||||||||||||||||||||||||||||||||||||

| Male | P | |||||||||||||||||||||||||||||||||||||||||||

| Female | P | P | ||||||||||||||||||||||||||||||||||||||||||

| Business Experience | ||||||||||||||||||||||||||||||||||||||||||||

| General Business Acumen | P | |||||||||||||||||||||||||||||||||||||||||||

| Financial Services Industry Knowledge | P | P | ||||||||||||||||||||||||||||||||||||||||||

| Experience in Managing Growth | P | |||||||||||||||||||||||||||||||||||||||||||

| Experience in Organization Development | P | |||||||||||||||||||||||||||||||||||||||||||

| Executive Experience & Knowledge | P | |||||||||||||||||||||||||||||||||||||||||||

| Financial Service Experience | ||||||||||||||||||||||||||||||||||||||||||||

| Audit, Compensation or Corporate Governance Experience | P | P | P | |||||||||||||||||||||||||||||||||||||||||

| Regulatory Experience | P | P | ||||||||||||||||||||||||||||||||||||||||||

| Large Shareholder Relationship Experience | P | |||||||||||||||||||||||||||||||||||||||||||

| Well Connected to the Community | P | |||||||||||||||||||||||||||||||||||||||||||

| Professional Experience | P | |||||||||||||||||||||||||||||||||||||||||||

| Collegiality | P | |||||||||||||||||||||||||||||||||||||||||||

| Industry Experience | ||||||||||||||||||||||||||||||||||||||||||||

| Accounting | P | |||||||||||||||||||||||||||||||||||||||||||

| Merchandising | ||||||||||||||||||||||||||||||||||||||||||||

| P | ||||||||||||||||||||||||||||||||||||||||||||

| Insurance | P | P | ||||||||||||||||||||||||||||||||||||||||||

| Technology | P | |||||||||||||||||||||||||||||||||||||||||||

| Asset Management | P | |||||||||||||||||||||||||||||||||||||||||||

| Community Relations | P | P | P | P | P | P | P | |||||||||||||||||||||||||||||||||||||

| Law | P | |||||||||||||||||||||||||||||||||||||||||||

| Management | P | |||||||||||||||||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash by Company ($) | Fees Earned or Paid in Cash by Subsidiaries ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Changes in Pension Value and Nonqualified Deferred Compensation Earnings(1) ($) | All Other Compensation ($) | Total ($) | |||||||||||||||||||||||||

| Ann W. Bresnahan | $ | 28,475 | $ | 9,200 | (2) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 37,675 | ||||||||||||||||

| Robert J. Campbell | 19,825 | 9,200 | (2) | — | — | — | — | — | 29,025 | ||||||||||||||||||||||||

| David C. Flanagan | 39,425 | 2,500 | (3) | — | — | — | — | — | 41,925 | ||||||||||||||||||||||||

| Craig S. Gunderson | 29,450 | — | — | — | — | — | — | 29,450 | |||||||||||||||||||||||||

| John W. Holmes | 27,450 | 1,500 | (3) | — | — | — | — | — | 28,950 | ||||||||||||||||||||||||

| James H. Page | 22,170 | 2,000 | (3) | — | — | — | — | — | 24,170 | ||||||||||||||||||||||||

| John M. Rohman | 27,165 | — | — | — | — | — | — | 27,165 | |||||||||||||||||||||||||

| Robin A. Sawyer | 32,320 | — | — | — | — | — | — | 32,320 | |||||||||||||||||||||||||

| Karen W. Stanley | 46,340 | 11,670 | (2)(4) | — | — | — | — | — | 58,010 | ||||||||||||||||||||||||

| (1) | We maintain a Directors Deferred Compensation Plan. Under this plan, deferred amounts are valued based on corresponding investments in certain investment funds which may be selected by the director. No plan earnings are considered to be “above-market” or “preferential” and as such no amounts are reported in this column. |

| (2) | Fees received as a director of Acadia Trust. |

| (3) | Committee fees received from Camden National Bank. |

| (4) | Fees received as chairman of Camden National Bank. |

| Compensation Components | Annual Retainer | Meeting Fee | ||||||||||

| Chair | Member | |||||||||||

| Camden National Corporation Board of Directors | $ | 15,000 | $ | 8,750 | $ | 1,000 | ||||||

| Camden National Bank Board of Directors | ||||||||||||

| Directors of Bank only | — | 5,600 | 600 | |||||||||

| Directors of both the Company and Bank | 10,000 | — | — | |||||||||

| Acadia Trust Board of Directors | 10,000 | 5,600 | 600 | |||||||||

| Audit Committee | 7,500 | — | 825 | |||||||||

| Compensation Committee | 7,500 | — | 825 | |||||||||

| Other Committees including: (i) Capital Planning; (ii) Corporate Governance and Risk; (iii) Technology; and (iv) Camden National Bank Committees | — | — | 500 | |||||||||

below.

Our shareholders may communicate directlyCompany and Bank, and their ages as of December 31, 2013 are:

| Name | Position with Company or Bank | Age | ||

| Gregory A. Dufour | President and Chief Executive Officer | 53 | ||

| Joanne T. Campbell | Executive Vice President, Risk Management | 51 | ||

| Peter F. Greene | Executive Vice President, Operations and Technology | 54 | ||

| Deborah A. Jordan, CPA | Executive Vice President, Chief Financial Officer | 48 | ||

| Timothy P. Nightingale | Executive Vice President, Senior Loan Officer | 56 | ||

| June B. Parent | Executive Vice President, Retail Banking | 50 | ||

Our Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors. The Code covers compliance with law; fair and honest dealings with the Company, with competitors and with others; fair and honest disclosure to the public; and procedures for compliance with the Code. You can review our Code of Conduct and Ethics on our website located atwww.camdennational.com.

In accordance with the Audit Committee charter, the Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management is responsible for preparing the financial statements and for designing and implementing the reporting process, including the system of internal controls, and has represented to the Audit Committee that such financial statements were prepared in accordance with generally accepted accounting principles. The independent registered public accounting firm is responsible for expressing opinions on the conformity of those audited financial statements with U.S. generally accepted accounting principles. The Audit Committee has reviewed and discussed with management and the independent registered public accounting firm, together and separately, the Company’s audited consolidated financial statements contained in the Company’s Annual Report on Form 10-K for 2012.

The Audit Committee discussed with the independent registered public accounting firm the matters required to be discussed by Section AU 380 of the Public Company Accounting Oversight Board’s (“PCAOB”) Interim Auditing Standards,Communications with Audit Committees, and related interpretations and rules. In addition, the Audit Committee has discussed with the independent registered public accounting firm the auditors’ independence from the Company and its management, including the matters in the written disclosures and letter which were received by the Audit Committee from the independent registered public accounting firm as required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence. The Audit Committee also considered whether the independent registered public accounting firm’s provision of non-audit services to the Company is compatible with the auditors’ independence, and concluded that the auditors are independent.

During 2012, the Audit Committee performed all its duties and responsibilities under the Audit Committee Charter. In addition, based on the reports and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements of the Company for 2012 be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, for filing with the Securities and Exchange Commission. Respectfully submitted by the members of the Audit Committee of the Board:

Robin A. Sawyer, CPA, ChairpersonAnn W. BresnahanRobert J. CampbellDavid C. Flanagan

The foregoing report shall not be deemed to be “soliciting material” or to be “filed” with the SEC and should not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such acts.

The following table shows, for the year ended December 31, 2012, information on compensation earned by or awarded to each non-employee director who served on the Company’s Board during 2012.

| Name | Fees Earned or Paid in Cash by Company ($) | Fees Earned or Paid in Cash by Subsidiaries ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Changes in Pension Value and Nonqualified Deferred Compensation Earnings(1) ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||

| Ann W. Bresnahan | $ | 18,200 | $ | 12,000 | (3) | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 30,200 | |||||||||||||||

| Robert J. Campbell | 15,100 | 12,000 | (3) | — | — | — | — | — | 27,100 | |||||||||||||||||||||||

| David C. Flanagan | 24,975 | 600 | (4) | — | — | — | — | — | 25,575 | |||||||||||||||||||||||

| Craig S. Gunderson | 20,125 | — | — | — | — | — | — | 20,125 | ||||||||||||||||||||||||

| John W. Holmes | 19,475 | 600 | (4) | — | — | — | — | — | 20,075 | |||||||||||||||||||||||

| Rendle A. Jones(2) | 20,875 | 12,600 | (5) | — | — | — | — | — | 33,475 | |||||||||||||||||||||||

| James H. Page | 16,225 | 600 | (4) | — | — | — | — | — | 16,825 | |||||||||||||||||||||||

| John M. Rohman | 18,450 | — | — | — | — | — | — | 18,450 | ||||||||||||||||||||||||

| Robin A. Sawyer | 18,325 | — | — | — | — | — | — | 18,325 | ||||||||||||||||||||||||

| Karen W. Stanley | 26,375 | 5,000 | (6) | — | — | — | — | — | 31,375 | |||||||||||||||||||||||

Directors who are also employees do not receive any compensation for serving as directors, or as members of committees. There were no changes to director compensation for 2012. Directors who were not employees during 2012 received a $625 monthly retainer ($775 for chairpersonsany of the Auditabove officers have been selected as officers. There are no “family relationships” among the directors and Compensation Committees), $600 for attendance at each meeting ofexecutive officers, as the Board of Directors, and $325 for attendance at each committee meeting ($500 for the Audit Committee) of the Board of Directors. The Chairman of the Compensation Committee also receives $500 for attendance at each committee meeting. In addition, the Chairman of our Company’s Board of Directors receives an annual retainer of $7,500. No additional fees were paid for membership on committees or for attendance at board or committee meetings.

In 2012, DirectorsCommission defines that were also a director of Camden National Bank (“Bank”), a subsidiary of the Company, received $200 for attendance at each Bank committee meeting they attended and the Chairman of our Company’s Board received an annual retainer of $5,000 as Chairman of the Bank’s Board of Directors. However, Company Directors did not receive the Bank’s Board of Directors’ monthly retainer of $400 or the fee for attendance at each meeting of $400. Directors that were also a director of Acadia Trust, a subsidiary of the Company, received a $12,000 annual retainer.

The Compensation Committee recommended the following changes to director compensation for 2013 after reviewing director compensation levels with assistance from our compensation consultant:

In addition, the Compensation Committee recommended that the annual retainer for the Chairperson of our Company’s Board of Directors increase to $15,000 and for the Chairperson of the Bank Board of Directors to $10,000. The new fee schedule was approved by the full Board of Directors and is effective as of January 1, 2013.

The Company maintains a Directors Deferred Compensation Plan under which each non-employee director of the Company and the Bank may elect to defer all or a portion of his or her annual retainer and/or chair and meeting fees. Under the Directors Deferred Compensation Plan, a participating director may elect from various payment alternatives, but full payout must occur no later than the tenth anniversary of the director’s separation from service. Deferred amounts are valued based on corresponding investments in certain investment funds (similar to those offered in our Company’s 401(k) Plan) which may be selected by the director. The Directors Deferred Compensation Plan is a nonqualified deferred compensation plan under which distributions are made from the general assets of the Company under the direction and oversight of the Compensation Committee.

The following discussion provides an overviewCraig S. Gunderson

The Company’s

Non-performing assets represented 1.13% of total assets as of December 31, 2012 compared to 1.27% at year-end 2011. This ratio has decreased slightly over last year, and seen a favorable shift in the composition with a decline in non-accrual loans and other real estate owned into restructured loans. Overall, the general weak economy, lower real estate valuations, and the impact from legislative changes lengthening foreclosure timelines, among other factors has contributed to the level of non-performing assets.

In 2012, the Company conducted an evaluation of its incentive plans with the consultation of McLagan and assistance from Human Resources and Risk Management, to ensure risk management processes, risk mitigation practices and the internal control structure are in place to maintain the Company’s risk profile within acceptable limits and ensure employees are not incented to take excessive risk positions. Based upon this review, the triggers that drive the awards, the business planning and budgeting processes, the internal controls which support the accurate reporting of actual results, and the risk management processes and mitigating features that ensure management operates within established risk tolerance guidelines, it was determined that the Company’s incentive plans do not lead to excessive risk taking pursuant to industry standards. Additionally, the plans lead to long-term value creation for the Company and demonstrate compliance with regulatory guidance on incentive compensation practices.

Annually, the2012.

The Compensation Committee believes that executive compensation should be linked with the Company’s performance and aligned with the interests of the Company’s shareholders. In addition, executive compensation should be designed to allow the Company to recruit, retain and motivate employees who play a significant role in the organization’s current and future success.

Three years ago, McLagan, the Company’s compensation consultant evaluated the Company’s total compensation package (base salary, annual incentive, and equity-based awards) for the Company’s executive team and the results indicated the Company’s executive compensation was below the market median (50th percentile) of the peer group. When evaluating the Company’s business performance relative to the peer group, the Company’s performance has ranked in the top 25th percentile when comparing return on equity, return on assets, and efficiency ratio. Accordingly, the Company’s relative business performance has ranked higher than the corresponding compensation level. Working with McLagan, the compensation consultant over the past several years, the Compensation Committee has improved alignment of the executive’s compensation closer to the 50th percentile of the peer data.

Each element of compensation paid to the Company’s named executive officers is designed to support one or more of the objectives described below under “Compensation Philosophy and Objectives.”

2013

Decisions regarding executive compensation are evaluated in light of the Company’s past performance, local and regional job market availability for each position, economic conditions in the state of Maine, and the Company’s short- and long-term business plans. Moreover, the Committee’s goal is to review and analyze each element of compensation, considering the entire compensation package. The Committee seeks to ensure that rewards for executives, such as annual incentives and equity compensation, are appropriate in relation to shareholder returns for the same period.

The Committee makes compensation decisions for the Company’s named executive officers, including the establishment of frameworks for how executives will be compensated and approval of recommendations regarding equity awards at the executive and non-executive levels. The Committee receives recommendations concerning these decisions from the CEO for executive officers and all other employees, other than the CEO. Decisions regarding non-equity compensation for non-executive officers are made by the CEO in conjunction with members of executive management. For non-executive officers, the CEO is responsible for establishing the framework on how these individuals will be compensated. These decisions, including salary adjustments and annual equity and non-equity incentive plan award amounts, are ultimately presented to the Committee for review. As is the case with the executive officers, the Committee can exercise its discretion in modifying recommended adjustments or awards for these individuals.

the 2012 Equity and Incentive PlanDCRP, by Bernstein, Shur, Sawyer & Nelson, P. A., to ensure compensation plans and programs are properly administered, documented, and meet legal and regulatory requirements.

the internal control structure are in place to maintain the Company’s risk profile within acceptable limits and ensure employees are not incented to take excessive risk positions. The most recent risk analysis was conducted in 2012 and minor changes were made to the plans in 2013. Based upon the 2012 review, the triggers that drive the awards, the business planning and budgeting processes, the internal controls which support the accurate reporting of actual results, and the risk management processes and mitigating features that ensure management operates within established risk tolerance guidelines, it was determined that the Company’s incentive plans do not lead to excessive risk taking pursuant to industry standards. Additionally, the Committee believes that the plans lead to long-term value creation for the Company and demonstrate compliance with regulatory guidance on incentive compensation practices.

constituencies with which the Company may compete to attract and retain executive talent.

| Alliance Financial Corporation | Enterprise Bancorp, Inc. | Provident New York Bancorp | ||

| Arrow Financial Corporation | Financial Institutions, Inc. | Rockville Financial, Inc. (MHC) | ||

| Bar Harbor Bankshares | First Bancorp, Inc. | Tompkins Financial Corporation | ||

| Berkshire Hills Bancorp, Inc. | Hingham Institution for Savings | TrustCo Bank Corp NY | ||

| Brookline Bancorp, Inc. | Independent Bank Corp. | United Financial Bancorp, Inc. | ||

| Canandaigua National Corporation | Merchants Bancshares, Inc. | Washington Trust Bancorp, Inc. | ||

| Century Bancorp, Inc. | Meridian Interstate Bancorp, Inc. (MHC) | Westfield Financial, Inc. | ||

The peer group was largely unchanged from the prior group: three peers were removed due to acquisition, and two peers were added that fit within the desired criteria: Beacon Federal Bancorp and Hingham Institution for Savings. Utilizing recent performance data, the Compensation Committee concluded the Company’s overall performance compared favorably with that of the peer group. For 2012, the Company’s return on average equity of 10.31% compared to a peer group median of 8.97% and a peer group average of 8.55%. For the same period, the Company’s return on average assets and efficiency ratio were 0.98% and 60.76%, respectively, compared to a peer group median of 0.84% and 65.77%, respectively, and a peer group average of 0.81% and 66.25%, respectively.

In the firstthird quarter of 2012,2013, the Committee engaged McLaganPM&P to conduct an Overall Compensation Reviewoverall compensation review of executive compensation. Salary levelsThe study indicated that 2013 base salaries for the NEOs ranged from 13% below to 1% abovenamed executive officers were within competitive range (+/- 15% of the corresponding peer medians,market median), and total compensation levels were all positioned between the 2540th and 7565th percentiles. The Committee will continue to make compensation adjustments, based on performance, where applicable, for alignment atwith the 50th percentile of peer group.

| Element | Description | Primary Objectives | ||

| Base salary | Fixed cash payment reflecting executive’s responsibilities, performance and expertise. | • Provide basic level of compensation | ||

• Recruit and retain executives | ||||

| Executive Incentive Plan (“EIP”) | Annual cash incentive which is contingent on achievement of Company and individual performance goals related to the current fiscal year. | • Encourage and reward individual and overall Company performance relative to current plans and objectives. | ||

| Long-Term Performance Shares (“LTIP”) | Executives can earn a number of shares (from zero to 200% of the target award) based upon Company’s achievement of performance objectives over a three-year performance period. | • Align the interests of executives with shareholders. | ||

• Promote achievement of long-term | ||||

| Management Stock Purchase Plan (“MSPP”) | Executives and officers at the level of Vice President and above receive restricted shares in lieu of a portion of annual incentive at a discount. Vest over two years. | • Retention | ||

• Promote stock ownership | ||||

| Restricted Stock Awards | Restricted stock awards, which typically vest over three years. Executives and officers at the level of Vice President and above awarded restricted stock. | • Retention | ||

• Promote stock ownership | ||||

| Stock Options | Executives and officers at the level of Vice President and above awarded options to purchase shares of common stock at fixed prices. Typically vest over five years. | • Retention | ||

• Promote stock ownership | ||||

| • Align the interests of executives with shareholders. | ||||

| Retirement and other benefits | Deferred compensation, retirement plans, retiree medical and other benefits. | • Retention | ||

• Competitiveness | ||||

• Financial security | ||||

| Change in control agreements | Severance benefits in the event of a termination of employment in connection with a change in control. | • Retention | ||

• Competitiveness | ||||

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-13-015510/v337671_chrt-bar.jpg)

Effective February 25, 2013, Mr. Dufour’s base salary was increased to $400,000 as a result of accomplishing strategic and individual goals, such as successfully integratingnegotiating and completing the acquisition of 14 new branch locationsbranches in October 2012, upgrading the Company’sCompany's ATM infrastructure, exceeding the 2012 net income budget, continued advancement of technology, investing in leadership development and core education programs, and educating

employees on the long-term strategic vision of the organization. It iswas the intent of the Compensation Committee to increase Mr. Dufour’sDufour's base salary to the 50th50th percentile of the peer groupgroup; however, Mr. Dufour voluntarily limited the salary increase for 2013.

| Name | Position | Base Salary 2/27/11 | Base Salary 2/26/12 | % Increase 2012 Over 2011 | Base Salary 2/25/13 | % Increase 2013 Over 2012 | ||||||||||||||||||

| Gregory A. Dufour | President & CEO | $ | 315,000 | $ | 390,000 | 23.8 | % | $ | 400,000 | 2.6 | % | |||||||||||||

| Name | Position | Base Salary 2/27/11 | Base Salary 2/26/12 | % Increase 2012 Over 2011 | Base Salary 2/25/13 | % Increase 2013 Over 2012 | ||||||||||||||||||

| Deborah A. Jordan | EVP & CFO | $ | 210,000 | $ | 216,300 | 3.0 | % | $ | 225,000 | 4.0 | % | |||||||||||||

| Peter F. Greene | EVP Operations and Technology | 170,640 | 175,759 | 3.0 | % | 185,000 | 5.3 | % | ||||||||||||||||

| Timothy P. Nightingale | EVP Senior Loan Officer | 202,650 | 209,000 | 3.1 | % | 215,000 | 2.9 | % | ||||||||||||||||

| June B. Parent | EVP Retail Banking | 169,600 | 177,688 | 4.8 | % | 192,000 | 8.1 | % | ||||||||||||||||

The Committee, with

2.25%.

| Name | Position | Base Salary 2/26/12 | Base Salary 2/25/13 | % Increase 2013 Over 2012 | Base Salary 2/23/14 | % Increase 2014 Over 2013 | ||||||||||||||

| Gregory A. Dufour | President & CEO | $ | 390,000 | $ | 400,000 | 2.6 | % | $ | 420,000 | 5.0 | % | |||||||||

| Deborah A. Jordan | EVP & CFO | 216,300 | 225,000 | 4.0 | % | 230,000 | 2.2 | % | ||||||||||||

| Peter F. Greene | EVP Operations/Technology | 175,759 | 185,000 | 5.3 | % | 189,000 | 2.2 | % | ||||||||||||

| Timothy P. Nightingale | EVP Senior Loan Officer | 209,000 | 215,000 | 2.9 | % | 220,000 | 2.3 | % | ||||||||||||

| June B. Parent | EVP Retail Banking | 177,688 | 192,000 | 8.1 | % | 197,000 | 2.6 | % | ||||||||||||

The annual EIP for executive officers, and other selected members of management, is tied specifically to the Company’s budget. Annual budgets are prepared by management and approved by the Board of Directors. In establishing the annual budget goals for the year, factors include the current operating environment (economic, interest rate, regulatory and local), as well as the Company’s strategic plan initiatives. Key financial ratios (return on assets, return on equity, earnings growth, asset quality and capital ratios) are measured against prior year performance, peer group and shareholder expectations. Potential awards are earned relative to performance to budget for the year based on budgeted net income before taxes (“NIBT”). The following table represents the 20122013 annual incentive opportunity based on NIBT.

| Annual Incentive Plan: 2012 Opportunity | ||||||||

| Incentives as % of Base Salary | ||||||||

| NIBT | Gregory Dufour | All Other NEO | ||||||

| 96% | 8% | 6% | ||||||

| 97% | 16% | 12% | ||||||

| 98% | 24% | 18% | ||||||

| 99% | 32% | 24% | ||||||

| 100% | 40% | 30% | ||||||

| 101% | 44% | 33% | ||||||

| 102% | 48% | 36% | ||||||

| 103% | 52% | 39% | ||||||

| 104% | 56% | 42% | ||||||

| 105% | 60% | 45% | ||||||

| 106% | 64% | 48% | ||||||

| 107% | 68% | 51% | ||||||

| 108% | 72% | 54% | ||||||

| 109% | 76% | 57% | ||||||

| 110% | 80% | 60% | ||||||

| EIP: 2013 Opportunity | ||||

| Incentives as % of Base Salary | ||||

| NIBT | Gregory Dufour | All Other NEO | ||

| 96% - Threshold Level | 4.0% | 3.0% | ||

| 97% | 8.0% | 6.0% | ||

| 98% | 12.0% | 9.0% | ||

| 99% | 16.0% | 12.0% | ||

| 100% - Target Level | 20.0% | 15.0% | ||

| 101% | 26.4% | 19.8% | ||

| 102% | 33.6% | 25.2% | ||

| 103% | 41.6% | 31.2% | ||

| 104% | 50.4% | 37.8% | ||

| 105% | 60.0% | 45.0% | ||

| 106% | 70.4% | 52.8% | ||

| 107% | 81.6% | 61.2% | ||

| 108% | 93.6% | 70.2% | ||

| 109% | 106.4% | 79.8% | ||

| 110% - Maximum Level | 120.0% | 90.0% | ||

| Annual Incentive Plan(1) | ||||||||||||

| Name | Position | 2011 | 2012 | |||||||||

| Gregory A. Dufour | President & CEO | $ | 187,270 | $ | 166,000 | |||||||

| Deborah A. Jordan | EVP & CFO | 93,000 | 71,000 | |||||||||

| Peter F. Greene | EVP Operations and Technology | 74,000 | 57,000 | |||||||||

| Timothy P. Nightingale | EVP Senior Loan Officer | 90,000 | 69,000 | |||||||||

| June B. Parent | EVP Retail Banking | 74,000 | 57,000 | |||||||||

The Compensation Committee recognizes the dedication of the named executive officer’s for their contribution to the success of the branch acquisition during 2012 and rewarded their efforts with a special cash bonus. The 2012 bonus was based on contributions relative to the due diligence, conversion and integration of 15 branches and over 55,000 retail deposit accounts and the sale and deconversion of one branch. These were in alignment with cash bonuses that were paid to the members of the Acquisition Steering Committee and Acquisition Project Team.

| Name | Position | 2012 Special Cash Bonus | ||||||

| Gregory A. Dufour | President & CEO | $ | 38,000 | |||||

| Deborah A. Jordan | EVP & CFO | 38,000 | ||||||

| Peter F. Greene | EVP Operations and Technology | 38,000 | ||||||

| Timothy P. Nightingale | EVP Senior Loan Officer | 10,000 | ||||||

| June B. Parent | EVP Retail Banking | 38,000 | ||||||

One objective of the executive compensation program is to increase executives’ equity ownership in the Company, which more closely aligns executive and shareholder interests by strengthening the executive’s personal investment in the success of our Company. To meet this objective, the Committee has utilized a long-term performance share plan, management stock purchase plan, restricted stock awards, and stock options. These programs reward executives with equity compensation, which more closely aligns the value ultimately received by named executive officers with the value created for other shareholders. The shares and options awarded generally have vesting schedules to enhance our ability to retain top performing officers, and annual or ongoing grants or purchases ensure the continuation of this value as options are exercised and shares vest.

Long-Term Performance Share Plan (or Long-Term Incentive Plan “LTIP”) — The LTIP, which is a sub-plan under the 2012 Equity and Incentive Plan, is administered by the Compensation Committee and intended to create a long-term incentive for the named executive officers, so that long-term interests of the Company are not compromised for short-term results. Awards made under the LTIP are used to achieve the twin goals of: (1) aligning executive incentive compensation with future increases in shareholder value; and (2) using equity compensation as a tool to retain key employees.

The target award level for each named executive officer is established based upon the executive officer’s level of responsibility in the Company. At the time of granting the awards, the Committee sets the award amount for each participant level to provide competitive long-term compensation. The target levels for each performance measure are set by the Committee for each long-term performance period, and are recommended by the Committee to the Board for approval. They are set in such a way as to ensure that the expense associated with the potential executive awards is an appropriate percentage of the resulting shareholder benefit. The Committee considers numerous factors in determining the target awards and the financial performance metrics based on management’s three year business plan. The analysis includes asset and income growth and the potential compensation expense under the LTIP is compared to the return to shareholders as measured by return on equity and earnings per share growth.

Each named executive officer has a predetermined “target award” which is reflected as a percentage of his or her base salary at the beginning of the long-term performance period. At the end of each long-term performance period, if the performance measure(s) and trigger(s) are met then each participant shall receive an award in accordance with the matrix, paid in Company shares. The conversion of dollar amounts into shares will be based on the market value of a share on the first day of the relevant long-term performance period. The table below details the award opportunity under the LTIPs for the 2010 – 2012 Plan, 2011 – 2013 Plan and 2012 – 2014 Plan (award opportunities have remained level over the last three years).

| Threshold | Target | Superior | ||||||||||

| LTIP Award Opportunity as % of Salary | ||||||||||||

| Gregory A. Dufour, President & CEO | 20.00 | % | 40.00 | % | 80.00 | % | ||||||

| Deborah A. Jordan, EVP & CFO | 12.50 | % | 25.00 | % | 50.00 | % | ||||||

| Peter F. Greene, EVP Operations and Technology | 12.50 | % | 25.00 | % | 50.00 | % | ||||||

| Timothy P. Nightingale, EVP Senior Loan Officer | 12.50 | % | 25.00 | % | 50.00 | % | ||||||

| June B. Parent, EVP Retail Banking | 12.50 | % | 25.00 | % | 50.00 | % | ||||||

The Committee designed the plan to include two performance measures and two triggers, with the reward being based on a sliding performance scale of threshold, target, and superior. The two performance measures selected for the LTIP are: (1) revenue growth and (2) efficiency ratio. The two triggers are: (1) maximum asset quality measure of non-performing assets excluding performing restructured loans (“Adjusted NPA”) to total assets not to exceed 2%, and (2) minimum level of earnings threshold for net income growth of 1%. In establishing performance measures, the Committee’s goal was to reward executives for profitable revenue growth in a challenging economic and regulatory environment while maintaining quality lending standards and providing net income growth to shareholders. In establishing the performance measures, the Committee directed management to focus on the core banking franchise and thus determined that the revenue growth and efficiency ratios measurements would exclude results of the wealth management subsidiary, Acadia Trust. In addition, the LTIP performance measures are subject to modification upon a merger or acquisition.

The following table details the LTIP performance measures and level of performance along with the cumulative compensation expense under each plan as recorded in the Company’s financial statementsCompany's actual NIBT, adjusted for the years ended December 31, 2012, 2011 and 2010.

| LTIP Performance Period | 2010 – 2012 | 2011 – 2013 | 2012 – 2014 | |||||||||||||||||||||

| Target Level | Actual End of Year 3 | Target Level | Actual End of Year 2 | Target Level | Actual End of Year 1 | |||||||||||||||||||

| Performance Metrics and Triggers | ||||||||||||||||||||||||

| Revenue growth(a) | 2.00 | % | 0.15 | % | 2.00 | % | (0.19 | )% | 2.00 | % | (2.83 | )% | ||||||||||||

| Efficiency ratio(a) | 55.00 | % | 53.94 | % | 53.50 | % | 53.75 | % | 53.50 | % | 54.07 | % | ||||||||||||

| Adjusted NPA | <2 | % | Achieved | <2 | % | — | <2 | % | — | |||||||||||||||

| Net income growth | 1% or greater | Achieved | 1% or greater | — | 1% or greater | — | ||||||||||||||||||

| Performance Level | ||||||||||||||||||||||||

| Expected Payout as a % of Target Incentive | 68 | % | 44 | % | 100 | % | ||||||||||||||||||

| Recorded Compensation Expense | $ | 228,000 | $ | 104,000 | $ | 131,000 | ||||||||||||||||||

In February 2013, the Board accepted the recommendationgoodwill impairment, of the Compensation Committee to award performance shares under the 2010 – 2012 LTIP to executive officers in the amounts set forth below (which represents the 68% of$37.8 million exceeded the target numberNIBT of shares)$36.8 million by 3%. The actual NIBT was adjusted by $2.8 million for the goodwill impairment write-down that the Committee believed should not impact 2013 performance shares earned but not distributed until 2013 are set forth inresults.

EIP Payments(1) | ||||||||||

| Name | Position | 2012 | 2013 | |||||||

| Gregory A. Dufour | President & CEO | $ | 166,000 | $ | 149,000 | |||||

| Deborah A. Jordan | EVP & CFO | 71,000 | 70,000 | |||||||

| Peter F. Greene | EVP Operations and Technology | 57,000 | 54,000 | |||||||

| Timothy P. Nightingale | EVP Senior Loan Officer | 69,000 | 56,000 | |||||||

| June B. Parent | EVP Retail Banking | 57,000 | 56,000 | |||||||

participant remains employed at the Company for such period. If a participant terminates employment for reasons other than retirement prior to the vesting date, he or she is reimbursed for the lesser of the amount originally used to purchase the restricted shares, or the current fair value of the shares on the date of termination. As with the other equity compensation programs, this program encourages investment in our Company and serves as a retention and recruitment tool. On March Management Stock Purchase Plan (“MSPP”) — The MSPP, available to all employees at the level of Vice President and above, is an equity incentive compensation plan designed to provide an opportunity for participants to receive restricted shares of our Company’s common stock in lieu of a portion of their annual bonus payments. Participants may elect to participate on a voluntary basis at either 10% or 20% of annual bonuses. The CEO and other named executive officers are required under this plan to participate at the 20% level when bonuses are administered. Restricted shares are granted at a discount of one-third of the fair market value of the stock on the date of the grant, and fully vest two years after the grant date if the9, 2012,8, 2013, each of the named executive officers deferred 20% of his or her bonus under the 2012 EIP and special bonus, resulting in a total of 4,3465,175 shares purchased under the MSPP at a price of $23.84.![]()

![]()

![]()

![]()

20122013 MSPP Stock Awards Name Position Number of Shares Vesting Period Gregory A. Dufour President & CEO 1,5711,814 2 Years Deborah A. Jordan EVP & CFO 780969 2 Years Peter F. Greene EVP, Operations and Technology 620845 2 Years Timothy P. Nightingale EVP, Senior Loan Officer 755702 2 Years June B. Parent EVP, Retail Banking 620845 2 Years